If you’re looking for a fresh opportunity in stablecoin yield farming and on-chain incentives, Falcon Finance is one of the standout platforms you should check out. It doesn’t just offer yield. It’s also building a full ecosystem where your participation is rewarded in ways that feel almost gamified.

Think of it like this: if most stablecoins are digital dollars you park in a vault, Falcon turns your dollars into frequent flyer miles, the more you use them, the more you earn back.

What is Falcon Finance?

Falcon Finance is a decentralized protocol focused on building a multi-chain stablecoin ecosystem with real utility and strong incentives for users.

Their main product is $USDf, a yield-bearing, fully collateralized stablecoin designed to integrate smoothly across major DeFi platforms. It’s not just a stable dollar replacement. It’s a productive asset, like a dollar that works overtime.

On top of that, Falcon introduces a unique Miles Points system, which works a bit like airline loyalty programs. You earn Miles by interacting with the protocol, whether you’re trading, providing liquidity, or minting USDf, and those points can later unlock airdrops, rewards, or premium benefits.

Falcon is live not just on Ethereum, but also on BNB Chain and XRPL EVM (via Axelar). This multi-chain approach enhances liquidity access and lets users deploy capital more efficiently. Integrations with platforms like WOO X, Pendle (PT‑sUSDf), and Morpho also mean you can use USDf or sUSDf across multiple DeFi strategies.

How It Works (Dual‑Token System)

Falcon runs on a smart dual-token model, which makes it easy to get exposure to both stability and yield.

- USDf: Mint it by depositing collateral like USDC, ETH, BTC, or USD1. It’s overcollateralized, meaning your deposited assets are always worth more than the USDf you mint, helping maintain price stability. Think of USDf like a digital stablecoin version of a security deposit, you always have more backing it than its face value.

- sUSDf: Stake your USDf and convert it into sUSDf, which earns yield from real, diversified sources like:

- Funding-rate arbitrageTokenized real-world assets (RWAs)Cross‑exchange lendingAnd more.

Who’s Backing Falcon Finance?

Falcon launched with early backing from DWF Labs, a respected Web3 investor and liquidity provider. They helped Falcon scale its liquidity and adoption early on.

Later, World Liberty Financial (WLFI), the team behind USD1, another emerging stablecoin, invested $10 million into Falcon. This partnership isn’t just about money; it enables closer integration between USDf and USD1, shared liquidity, and multi-chain expansion.

Falcon by the Numbers (TVL, Supply & Yield)

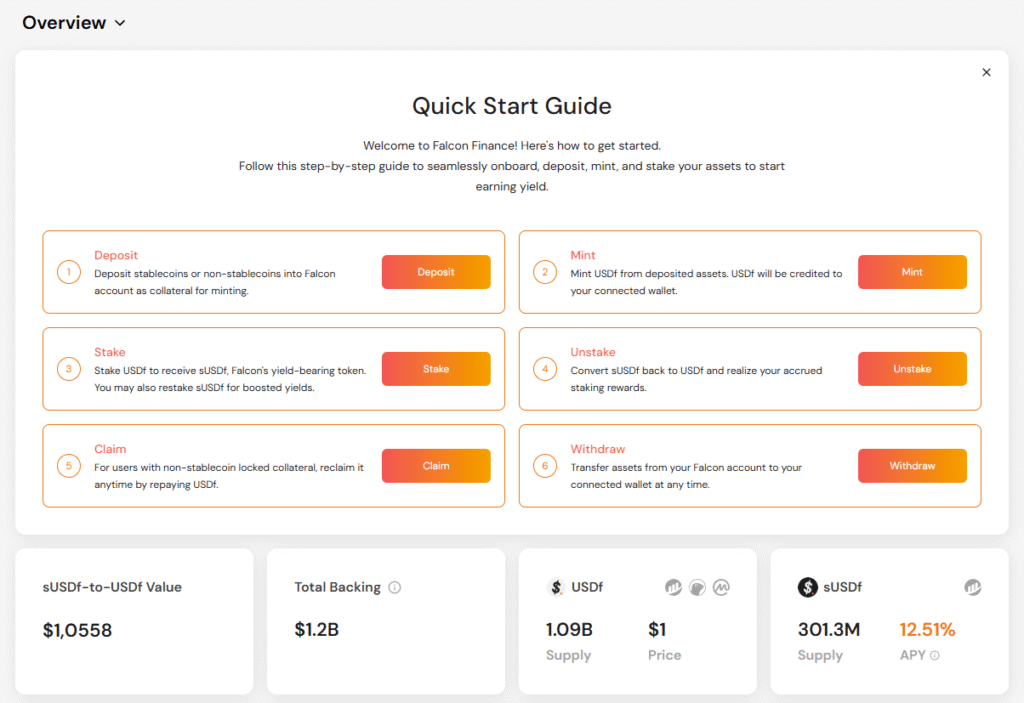

Falcon is growing fast. Here’s what the latest numbers look like:

- $USDf supply: Surged past $648M and is now climbing over $1.1B

- TVL (Total Value Locked): Recently crossed $1.2B, representing the assets backing USDf

- Collateralization: Remains strong at 115%+, with real-time dashboards and third-party audits

- sUSDf APY: Ranges between 10.8% and 12.8%, depending on market conditions and strategies. In plain terms: you’re getting some of the highest stablecoin yields available without exposing yourself to volatile assets.

Falcon Miles: The DeFi Loyalty Program

Falcon Miles are points you collect when using the protocol. Like an airline or credit card rewards system, your activity is constantly being tracked and rewarded. The more you participate, the higher your score, the more perks you unlock.

- Minting, staking, LPing, referrals, and trading all earn you points

- Some activities offer up to 60x multipliers

- Partners like Pendle, Euler, Morpho, Napier, and Spectra are also eligible

Miles could be used for future token drops, governance power, or exclusive ecosystem benefits. Think: DeFi with a frequent flyer twist.

LP Strategy: Farm Miles While Earning Yield

When you add liquidity to Falcon’s pools, you get the best of both worlds, yield AND Miles. Here’s how it breaks down:

- USD1/USDf pool: 60x Miles per $ per day

- USDT/USDf pool: 50x Miles per $ per day

- Plus, you earn 3x Miles per $ of trading volume

Heads-up: After August 13, the pool multipliers will adjust to:

- 40x Miles per $ per day

- 2x Miles per $ trading volume

Still, those rates remain competitive compared to other stablecoin LP pools, even on Ethereum mainnet.

Step-by-Step: How to Start LP-ing $USDf on BNB Chain

Don’t worry if you’ve never done this before. LPing is easier than it sounds. This guide is provide by CoinFoin:

① Get $USDf on BNB Chain

- Option 1: Swap directly on PancakeSwap

② Prepare Your LP Pair

You’ll need either USD1 or USDT to match your USDf. Merkl’s reward split looks like this:

- 50% based on fees

- 40% weighted by USDT

- 10% based on USDf

Make sure your LP position is in-range and active to qualify for rewards.

③ Add Liquidity

Pick your preferred pool:

- USD1/USDf Pool

- USDT/USDf Pool

No Time for LPing? Try the $sUSDf Vault Instead

If LPing feels like too much of a hassle, there’s an easier way: just deposit into the $sUSDf Vault. It’s a “set-it-and-forget-it” option that still gives you exposure to the protocol’s yield strategies, without needing to manage LP positions.

In fact, sUSDf APY once hit 14.01%, making it one of the highest passive stablecoin yields available in DeFi.

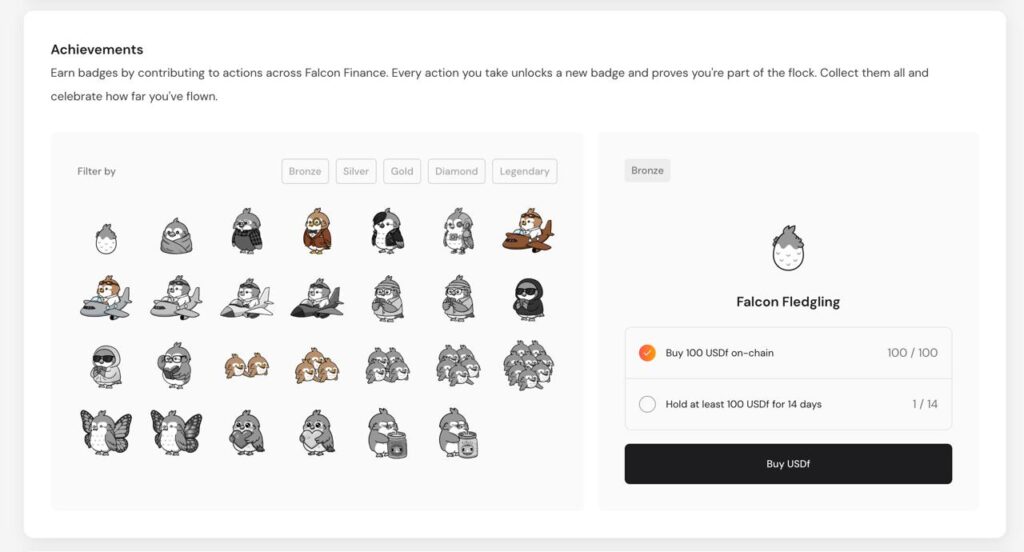

Don’t Forget to Collect Falcon Badges

Falcon also rewards you with Badges, which may unlock hidden multipliers, bonus Miles, or special benefits down the line.

Think of them like in-game achievements, fun to collect now, valuable later.

If there’s something you want me to cover next, just let me know. You can follow me here on my website and my Medium to get my latest updates as soon as they drop! You can also contact me through X @AskaraJr and Linkedin