The crypto industry has never stopped evolving. Each year brings fresh innovations, new opportunities, and a different flavor of hype. But while we often focus on what’s trending today, I think it’s worth taking a step back. Let’s revisit some of the things that were once huge in crypto but are now either fading into history or no longer pulling the weight they used to.

This is not just about nostalgia. It’s also about understanding how fast this space moves and why adapting is the only way to survive in it.

1. GPU Mining Glory Days

Back in the mid-2010s, GPU mining felt like a treasure hunt anyone could join. You didn’t need a massive warehouse or millions in capital. A decent graphics card and some determination could get you mining Ethereum, Zcash, or other altcoins. Many early adopters literally ran mining rigs in their bedrooms, with fans blowing and electricity bills spiking.

However, those days are mostly gone. Bitcoin mining moved to ASICs years ago, and Ethereum’s shift from Proof of Work to Proof of Stake in 2022 pulled the rug from under GPU miners. Yes, a few smaller PoW coins remain, but profits are a shadow of the past. What used to be a booming DIY industry is now a niche hobby.

2. The Wild ICO Rush

If you were around in 2017, you’ll remember how Initial Coin Offerings took over the scene. Anyone could create a token, write a whitepaper, and raise millions from eager investors. The possibilities felt endless, and for a while, it seemed like a new “Ethereum killer” launched every week.

But the 2018 crash and countless scam projects turned the gold rush into a graveyard. Regulators stepped in, and investor trust took a big hit. While token launches still exist today in forms like IEOs (Initial Exchange Offerings) and IDOs (Initial DEX Offerings), the reckless days of throwing ETH at a whitepaper are long gone.

3. Bitcoin Faucets That Actually Mattered

Imagine visiting a website, clicking a button, and receiving whole Bitcoins for free. That’s not a fantasy. In 2010, Gavin Andresen’s faucet gave away 5 BTC per claim to promote Bitcoin adoption. Back then, it wasn’t worth much, so nobody thought twice about giving it away.

Fast forward to today, faucets still exist, but they pay fractions of a cent in crypto. The massive giveaways became unsustainable as Bitcoin’s value skyrocketed. For most people now, faucets are just a nostalgic reminder of how early days felt like a small club of enthusiasts sharing a secret.

4. Telegram Pump Groups

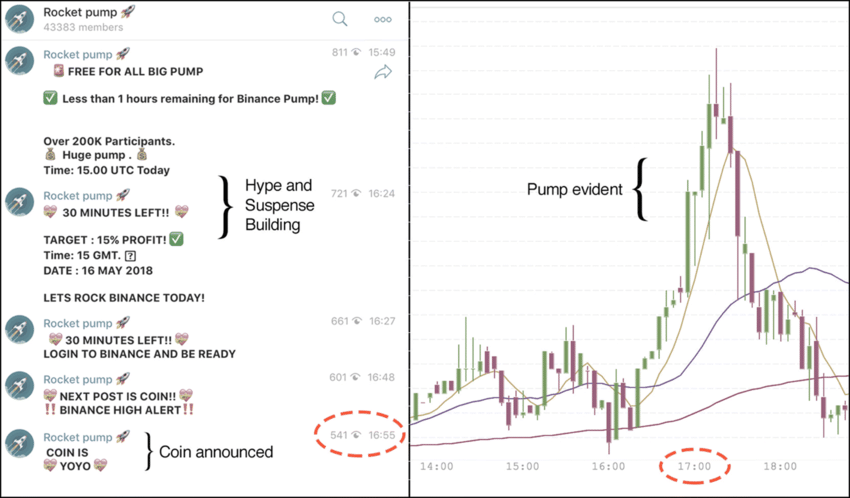

At one point, it felt like every other crypto trader was in a Telegram group dedicated to pumping small altcoins. The playbook was simple: pick a coin, announce the “pump time,” and watch the price spike as members piled in. Some made quick profits, but most ended up holding bags when the coin crashed minutes later.

As the market matured, pump groups lost their edge. Exchanges implemented stricter rules, bots became too fast, and new opportunities like DeFi farming and meme coins stole the spotlight. Pump-and-dump still exists in corners of the market, but the hype is nowhere near what it used to be.

5. Life-Changing Airdrops

Early airdrops were legendary. Projects like Stellar in 2014 or Uniswap in 2020 handed out tokens worth hundreds or even thousands of dollars to anyone who met simple requirements. It was the golden age of “free money” for being early.

These days, airdrops are still around, but the magic has faded. Requirements are stricter, competition is higher, and rewards are usually smaller unless you are a heavy DeFi or NFT user. The thrill of waking up to find a massive token drop in your wallet has become rare.

6. Mining From Your Laptop or Phone

In Bitcoin’s earliest days, you could mine directly from a laptop CPU. Even by 2014, some Android apps offered mobile mining for small altcoins. It felt empowering to generate coins from the device in your hand.

Today, the mining difficulty for major coins is far beyond what a consumer device can handle. Mobile “mining” apps are mostly simulations or marketing gimmicks. For actual mining, specialized rigs or massive facilities have taken over.

7. The Bitcoin Fork Explosion

When Bitcoin Cash split from Bitcoin in 2017, it was like opening floodgates. Suddenly, forks like Bitcoin Gold, Bitcoin Diamond, and Bitcoin Private appeared, promising to “fix” or “improve” Bitcoin. Holders of BTC received free coins in each fork, which sparked excitement and speculation.

But most of these forks failed to gain real traction. Their communities shrank, development slowed, and liquidity dried up. Today, forks are rare and barely make headlines.

8. Mt. Gox: The Giant That Fell

From 2010 to 2014, Mt. Gox was the center of the Bitcoin trading world, handling over 70% of all transactions. For many, it was the only exchange they knew. But when it collapsed after losing 850,000 BTC, the shock reshaped the industry.

That disaster pushed the community toward more secure, regulated, and diversified exchanges. Platforms like Binance, Coinbase, and Kraken dominate today, but Mt. Gox remains a cautionary tale of centralization and security risks.

Why This Matters

Looking back at these faded trends reminds me how quickly things change in crypto. What’s hot today could be irrelevant in a year. It’s not just about chasing the next big thing; it’s about understanding the cycles, adapting to new realities, and remembering the lessons that history has taught us.

For newcomers, this is a reminder that the crypto world you see today is just one snapshot in a constantly evolving story. Ten years from now, we might look back on some of today’s trends with the same mix of nostalgia and disbelief.

If you ever feel like you “missed the boat,” remember that boats keep coming. The sea of crypto never stands still, and there is always another wave to catch.

If there’s something you want me to cover next, just let me know. You can follow me here on my website and my Medium to get my latest updates as soon as they drop! You can also contact me through X @AskaraJr and Linkedin