Over the years, Bitcoin has been praised as a revolutionary currency that can help people in ways traditional money cannot. For some, it feels like a financial lifeline, especially in countries where inflation is high, the local currency is unstable, or the banking system is unreliable. But for others, it seems too risky, especially for people who are already struggling to make ends meet.

I have seen these two opinions clash many times, and both have strong points. To understand why the debate exists, we need to take a closer look at how Bitcoin can help in a struggling economy and why it might also be a challenge for those who are already under financial pressure.

Why Bitcoin Can Be a Lifesaver

First, let’s look at the reasons some people call Bitcoin a lifesaver. Imagine living in a country where your money loses value almost every day. You work hard, get paid, but by the time you buy groceries next week, your money can buy less than it did before. That is the reality in some countries with very high inflation.

In such situations, Bitcoin can act as a hedge. Since Bitcoin is not tied to one specific country’s economy, it is less affected by local currency problems. People can store their wealth in Bitcoin and avoid watching their savings melt away due to inflation.

Another benefit comes from its ability to work as a borderless payment system. In countries where banks are slow, unstable, or heavily restricted, Bitcoin gives people a way to send and receive money quickly without relying on local banking networks. This is not just about sending money abroad. It can also mean paying a supplier in another city, receiving payments for online work, or helping family members in other countries.

Some countries are even experimenting with making Bitcoin part of their official economy. The most famous example is El Salvador, which adopted Bitcoin as legal tender. The government there has made gradual purchases, treating Bitcoin as both an investment and a form of money. This move attracted global attention and increased tourism. For people in El Salvador who use Bitcoin daily, it can feel empowering to have an alternative to their traditional currency.

In short, for those who plan well and know how to use it, Bitcoin can protect wealth, improve payment systems, and open doors to opportunities that a struggling local currency cannot offer.

Why Bitcoin Can Be a Risk in Struggling Economies

Now, let’s shift to the other side of the discussion. When an economy is in crisis, people often have one main goal: survival. Instead of thinking about investments, they focus on how to pay for food, rent, and daily needs.

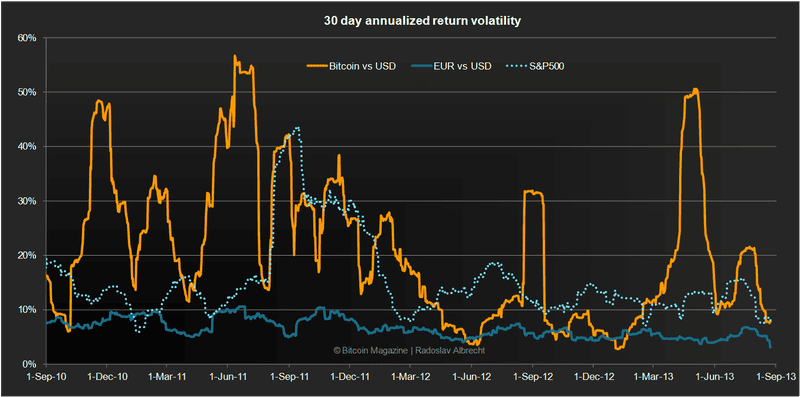

Here is where Bitcoin faces a problem. It is highly volatile. The value can go up or down by a large amount in a single day. If you are already stressed about money, the idea of watching your savings lose 20% of their value overnight is not comforting.

Digital payments in general are also not always easy. They can be taxed heavily, charged with extra fees, or require a level of internet access and technology that not everyone has. While the need for digital payments is growing, many people still prefer cash or stable bank transfers because they are predictable.

The most important point is that in a bad economy, stability is everything. People need a currency they can trust not to swing in value every few hours. Bitcoin’s unpredictability makes it feel like a gamble for those living paycheck to paycheck. In many cases, only wealthier individuals, speculators, or early adopters benefit significantly from Bitcoin. The average person may not have the resources to take that kind of risk.

Learning from El Salvador’s Example

When we talk about Bitcoin in struggling economies, El Salvador’s story often comes up. The country’s adoption of Bitcoin did bring investment, tourism, and international attention. However, the experience also shows that Bitcoin works best for those who can afford to wait through its ups and downs.

For the lower-middle class, the situation is different. They cannot risk losing value overnight because that money is needed for daily living. While El Salvador’s government continues to hold Bitcoin as part of its reserves, everyday citizens may still prefer to receive and spend in a stable currency.

This highlights a key truth: Bitcoin’s benefits are more noticeable when you have extra funds to invest. For those with limited income, the focus remains on financial stability first, and long-term investments second.

A Middle Ground Perspective

After looking at both sides, I believe the reality is somewhere in between. Bitcoin is not a magic solution for every struggling economy, but it is also not useless. It is simply a tool, and like any tool, its value depends on how and when it is used.

For wealthier individuals, tech-savvy entrepreneurs, and forward-thinking governments, Bitcoin can be a smart hedge against currency devaluation. For someone running an online business, it can be a reliable way to receive international payments. and For a country that wants to diversify its reserves, it can be part of a larger investment strategy.

If you are the average citizen, especially those living on a tight budget, the story is different. Bitcoin may be too risky for daily savings unless they use it only as a small portion of their finances. A mix of stable currency for everyday needs and Bitcoin for longer-term storage might be the safer path.

What Needs to Happen for Bitcoin to Help More People

If Bitcoin is to play a bigger role in helping struggling economies, two things must happen.

First, volatility needs to decrease. This could happen over time as more people and institutions use Bitcoin, creating a more stable market. Second, infrastructure needs to improve. Access to affordable internet, secure wallets, and easy payment systems will make it easier for the average person to use Bitcoin without extra stress.

If these improvements happen, Bitcoin could become more than just a hedge for the wealthy. It could be a true everyday currency in countries where local money is weak or unreliable.

So..

The question of whether Bitcoin is a lifesaver or a risky gamble in struggling economies does not have a one-size-fits-all answer. It depends on a person’s financial situation, risk tolerance, and access to technology.

For some, Bitcoin is a shield against inflation and a gateway to global markets. For others, it is a dangerous distraction from the need for stable income and predictable expenses. Both perspectives are valid, and both deserve to be part of the conversation.

In the end, Bitcoin is neither the hero nor the villain. It is a powerful option in the financial toolkit, but one that must be used carefully. For struggling economies, stability will always come first. Yet with the right strategy and infrastructure, Bitcoin could play a bigger role in helping people escape financial hardship in the future.

If there’s something you want me to cover next, just let me know. You can follow me here on my website and my Medium to get my latest updates as soon as they drop! You can also contact me through X @AskaraJr and Linkedin