About 2 days ago, I sat at my desk, staring at yet another chart. The crypto world was buzzing with a new name: Aster. Everyone seemed to be talking about it. Articles popped up left and right, the token price shot up, and screenshots filled my feed. Some people even whispered the boldest claim of all: “Could this be the HyperLiquid killer?”

I couldn’t resist. As someone who owes life-changing gains to HyperLiquid (HYPE), I was curious. I wanted to know if this newcomer could really shake the throne. So, I did what any trader would do—I rolled up my sleeves, dug into Aster, and even placed a small test trade.

Aster First Test: Excitement Meets Friction

At first glance, Aster felt polished. The interface was clean, fees looked extremely low, and there was a shiny feature called Hidden Orders. For a moment, I felt a spark of excitement. Could this really be the next big thing?

You can try to open an account in Aster by clicking here: Aster DEX

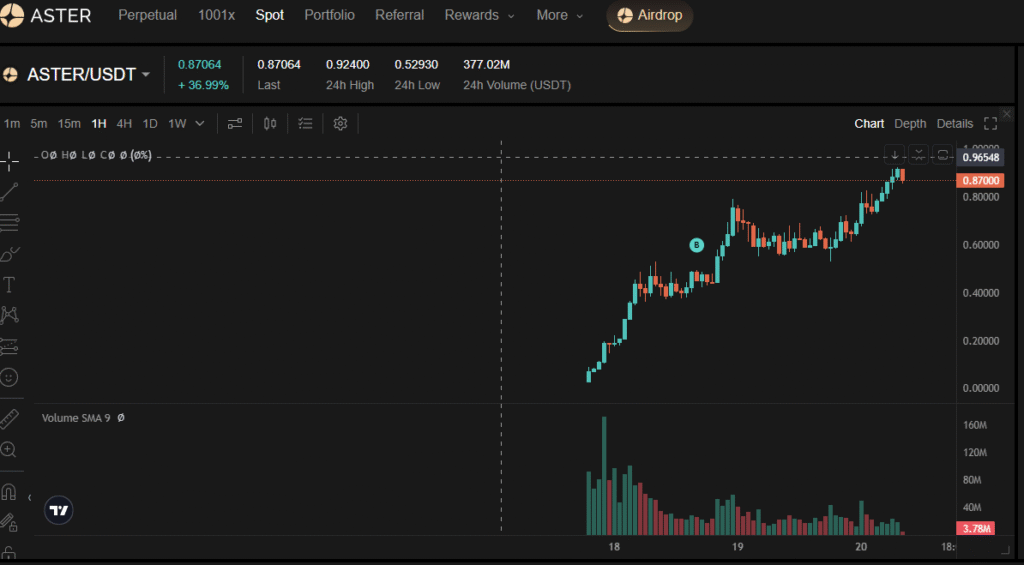

Actually, I was a little late joining because I was still rolling my funds around in other DeFi projects that were approaching their deadlines. I bought when the price was around $0.47

and what was the price when this article was typed? It was as high as $0.9!

In the early days, there were indeed withdrawal issues, but it seems that they have been resolved.

That moment taught me something about myself. Deep down, I wanted Aster to beat HyperLiquid. Not because I disliked HL, but because as traders we are always searching for “better.” We chase smoother experiences, lower fees, and more powerful tools. Sometimes our hunger for the next big thing says more about us than about the platforms themselves.

Liquidity: The Real Heart of Aster vs Hype Battle

However, all the excitement in the world can’t hide the most important question: how strong is the liquidity? In trading, liquidity is like oxygen. You don’t notice it when it’s there, but the second it disappears, you’re in trouble.

- HyperLiquid runs on an on-chain central limit order book (CLOB) built on a custom Layer 1 blockchain. This means liquidity is organic, structural, and deeply rooted in the system. Traders come because the depth is real, not because someone is paying them to show up. It’s like a natural spring that keeps flowing no matter what.

- Aster looks deep right now, but that depth is powered by market maker incentive programs and ultra-low fees. While it feels impressive, it is more like a water tank. It works perfectly when someone keeps it filled, but if incentives fade, the tank could dry up quickly.

Decentralization and Trust

When it comes to decentralization, the difference becomes even clearer.

- HyperLiquid makes every order, every cancellation, and every fill happen directly on-chain. Even if the front end goes offline, the network continues. No black-box sequencer, no single choke point. That level of neutrality is hard to match.

- Aster, on the other hand, settles trades non-custodially, which is good. But the matching engine is still centralized. This means there is still one door that could be closed if things go wrong. For traders who value censorship resistance above all else, that is a real concern.

Speed vs Durability

One area where Aster shines is speed. Trades feel fast and cheap, and the user interface is undeniably smooth. This is because much of the matching happens off-chain. It feels like racing on a freshly paved highway, but you don’t own the road.

HyperLiquid, in contrast, gives you sub-second finality on-chain. It manages to combine high-frequency-trading performance with full transparency. That’s like building your own road, one that never needs outside permission to keep cars moving.

So..

Crypto is filled with bold claims and flashy launches. But in the end, one truth remains: liquidity is everything. Aster has proven it can capture attention and bring traders in quickly. Yet HyperLiquid continues to show why structure and transparency matter most.

Because where market makers can play in the shadows, the trader rarely wins. And in this story of two DEXs, I’ll stick with the one that shines brightest under the light.

If there’s something you want me to cover next, just let me know. You can follow me here on my website and my Medium to get my latest updates as soon as they drop! You can also contact me through X @AskaraJr and Linkedin