When I first discovered crypto, it felt like walking into a vibrant open-air market where anyone could set up a stall. There were no tall gates to pass through, no security guards checking your bags, and no one telling you what you could or could not trade. The air buzzed with opportunity and the promise of freedom. That was the dream many of us signed up for.

Over time, that open market has started to feel more restricted. Large corporations are building massive stalls that block out the sunlight. Governments are setting up watchtowers at every corner. The space is technically still open, but the feeling is not the same anymore. It makes me stop and wonder: are we still as free as we think?

Big Corporations Have Entered the Game

Let’s start with the corporate side of the story. When companies like MicroStrategy, Tesla, or giant investment firms buy enormous amounts of Bitcoin or other cryptocurrencies, it is a bit like one customer walking into our open market and buying half the supply of oranges. They have the right to do it, but their move shifts the balance. They can influence prices and change the entire mood of the market.

Today, institutional investors control a significant share of Bitcoin’s total supply. When they decide to make a large purchase or sell a big portion, the price can swing in ways that smaller traders cannot match. Imagine living in a neighborhood where one person owns most of the land. Everyone else eventually has to adapt to whatever that one person decides.

On top of that, corporations are accountable to their shareholders. They have profit targets to reach and quarterly results to present. The decisions they make are not guided by a mission to protect crypto’s freedom. They are guided by the need to keep numbers high and investors happy. That focus on profit does not always match the values that first inspired the crypto movement.

Governments Are Now Taking a Seat

Now let’s move to the role of governments. Some nations are beginning to hold cryptocurrency as part of their official reserves. The United States, for example, has established a Strategic Bitcoin Reserve. At first glance, this can feel like a huge step forward for mainstream adoption. Yet governments rarely hold assets without wanting some influence over how those assets are managed.

Regulations have also become much stricter. Most major exchanges now require KYC (Know Your Customer) and AML (Anti-Money Laundering) verification. To a newcomer, these might look like simple sign-up steps. In reality, they link every transaction you make to your personal identity. The freedom to transact anonymously, one of crypto’s early promises, is slowly disappearing from many parts of the ecosystem.

It is similar to when a shiny new shopping mall opens in town. At first, it is exciting with its air conditioning, clean floors, and endless variety. Over time, though, the small family-run shops start disappearing. They are replaced by big brands that all feel the same. The convenience is still there, but the character and independence of the old market have been lost.

The Rise of CBDCs and Their Hidden Costs

While governments are tightening control over existing crypto, they are also introducing Central Bank Digital Currencies, or CBDCs. These are not like Bitcoin or Ethereum. CBDCs are fully centralized, giving the issuing authority complete control. Every transaction can be monitored, limited, or even reversed.

Imagine going to pay for your coffee and the cashier telling you that your CBDC wallet has been locked for “security checks.” Or imagine certain purchases being blocked entirely because they do not meet newly issued guidelines. That is the kind of direct control CBDCs could allow.

From a technology perspective, CBDCs are impressive. From a freedom perspective, they are like trading your personal bicycle for a bus ticket. You can still travel, but only along approved routes, on a schedule someone else controls.

Remembering Why Crypto Was Created

When Satoshi Nakamoto introduced Bitcoin, it was not just about creating a new form of money. It was about giving people the power to transact without needing permission from a central authority. It was about storing value in a way that could not be frozen or seized by a bank.

This idea became popular because traditional finance can feel like a locked building with a guard at the front door. Crypto kicked that door wide open. Yet slowly, some of the same gatekeepers are finding their way back in, this time wearing different uniforms.

Are We Still Free in the Crypto Space?

The answer depends on how you define freedom. Technically, yes, you can still create a wallet without a bank account, use decentralized exchanges, and send funds across the world in minutes. In practice, however, the areas where you can do this without oversight are shrinking.

Think of it like going to a public beach where hotels keep buying more shoreline. You can still swim in the ocean, but there are fewer places to lay your towel.

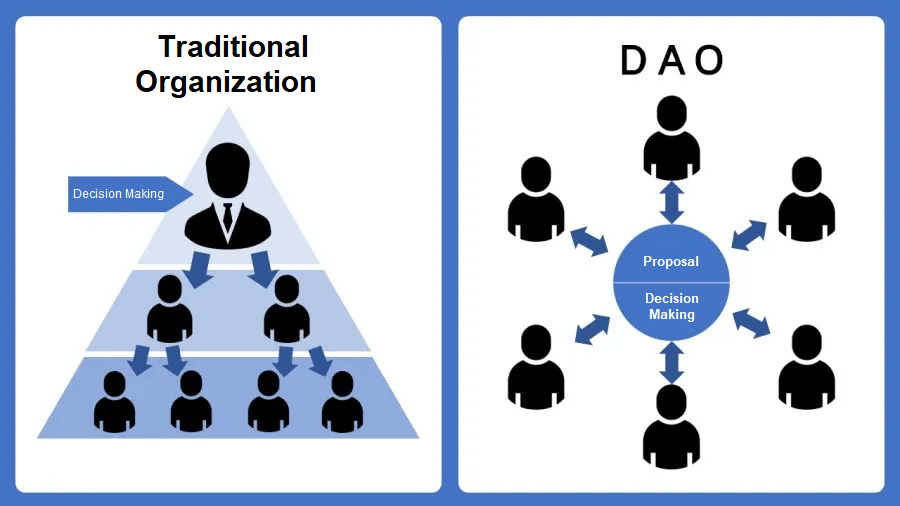

The Fight for Decentralization Continues

There is still good news. The fight for decentralization is far from over. Decentralized Autonomous Organizations, or DAOs, are giving communities a direct say in how projects are run. Decentralized finance, known as DeFi, is creating banking alternatives that do not require approval from a central body. Privacy-focused coins such as Monero and Zcash still offer anonymity, although they face increasing regulation.

Peer-to-peer marketplaces and non-custodial wallets are also thriving. If you control your own private keys, no company or government can freeze your funds without your consent. It is like having your own safe at home that only you know how to open.

Why This Matters for Newcomers

If you are new to crypto, this might sound like a tug-of-war between large institutions and passionate communities. But your everyday choices make a difference. Every time you choose a decentralized platform over a centralized one, you are voting for the open market instead of the fenced-off shopping mall.

Learn how to use self-custody wallets. Try decentralized exchanges. Support projects that put community governance first. This does not mean ignoring regulations entirely. Security still matters. But it does mean protecting the original spirit of crypto.

The Road Ahead

Crypto is still young when compared to traditional finance. The balance of power is still shifting. That gives us a rare opportunity to shape the direction this industry will take.

If we allow convenience to outweigh decentralization, we could wake up to a system that looks almost identical to the one crypto was meant to replace. If we stay informed, make careful choices, and keep using decentralized tools, we can preserve the open, borderless marketplace that started it all.

Freedom in crypto will never be something we can take for granted. It is something we must protect by participating, building, and making conscious decisions. Companies and governments will always try to set up shop here. Whether they become part of a balanced ecosystem or take control entirely will depend on what we, as everyday users, choose to do.

So, are we still free? For now, yes. The bigger question is whether we will fight to keep it that way.

If there’s something you want me to cover next, just let me know. You can follow me here on my website and my Medium to get my latest updates as soon as they drop! You can also contact me through X @AskaraJr and Linkedin