If you’ve been around the crypto or financial world, you’ve probably seen terms like Market Cap, TVL, and FDV thrown around. For beginners, these terms might sound technical or even intimidating,but trust me, once you get the hang of them, they’re pretty simple.

In this article, I’ll explain what they mean, how they’re calculated, and share some easy analogies to make it all click. So grab your coffee, sit back, and let’s talk numbers in plain English!

What is Market Cap?

Market Cap stands for Market Capitalization. It shows how much a cryptocurrency or stock is worth in total based on the current price and total circulating supply.

The Formula:

Market Cap = Current Price x Circulating Supply

Imagine you’re at a fruit market, and someone is selling apples. One apple costs $2, and they have 1,000 apples on display.

So, the total value of all apples on the table is:

$2 x 1,000 = $2,000

That’s basically what Market Cap tells you how much the “market” values all the coins or tokens currently in circulation.

Market Cap helps you quickly understand the size and risk of a project. Bigger cap usually means less volatile, while small cap coins might have more growth potential, but also more risk.

What is TVL (Total Value Locked)?

TVL stands for Total Value Locked. This is mostly used in DeFi (Decentralized Finance) projects. It shows how much money is currently “locked” or being used in a protocol like staking, lending, liquidity pools, or vaults.

The Formula:

There’s no complex formula here. TVL just adds up the actual value of assets people have locked in a project.

Imagine you and your friends all put money in a piggy bank to start a mini lending club.

You put $100, your friend puts $200, and another friend adds $700.

Your TVL?$100 + $200 + $700 = $1,000

That’s it! TVL tells how much trust people have in a DeFi platform. The higher the TVL, the more users are interacting with the protocol.

High TVL often means a healthy ecosystem. It shows real usage, not just hype. But always check where the value is locked and whether it’s sustainable.

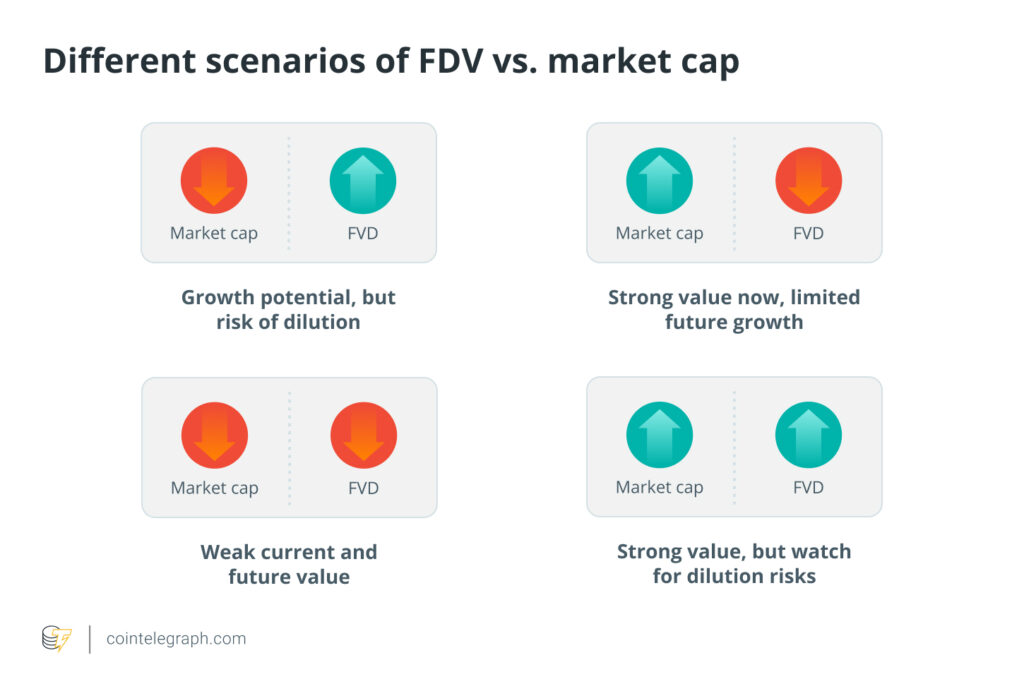

What is FDV (Fully Diluted Valuation)?

FDV shows the total market value if all the tokens were in circulation. Some tokens are still locked or not yet released, so FDV gives a “what if” scenario.

The Formula:

FDV = Current Price x Total Supply (including locked tokens)

let’s say the farmer only put 1,000 apples on display, but he has 9,000 more apples in the back that he plans to sell later.

So while the current Market Cap is:$2 x 1,000 = $2,000

The FDV would be:$2 x 10,000 = $20,000

Even though those 9,000 apples aren’t on the table yet, FDV helps you understand the full picture, including future impact when those extra apples hit the market.

FDV is important because a token with a small market cap but huge FDV might be overvalued once the locked tokens get released. That release could cause price dilution, making the token drop if demand doesn’t grow at the same pace.

Final Thoughts

Understanding Market Cap, TVL, and FDV is like learning the language of the crypto world. Once you know these three terms, you’ll start seeing through the hype and making smarter decisions.

You’ll know when something is undervalued, overhyped, or just a solid long-term play. And trust me — that edge matters, especially in a fast-moving space like crypto.

So the next time you check CoinGecko or CoinMarketCap, don’t just look at price. Check Market Cap to see its size, TVL to gauge usage, and FDV to spot potential dilution.

Learning these terms may not make you rich overnight, but they will make you wiser — and in crypto, that’s half the battle.

If there’s something you want me to cover next, just let me know. You can follow me here on my website and my Medium to get my latest updates as soon as they drop! You can also contact me through X @AskaraJr and Linkedin